A credit report shows you a snapshot of your credit history. Before we can discuss how to improve your credit scores, you need to understand how to read and understand a credit report. Once that’s settled, in future posts we’ll go into more detail on how to assess your credit and improve the dreaded low credit score.

What information is used to assess your credit score?

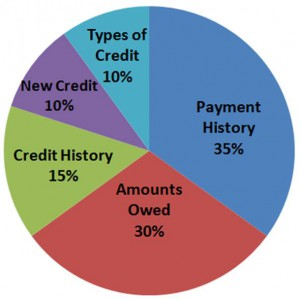

Credit bureaus will collect information from public records and companies from which you have taken out loans or credit. With the information provided, they will create a credit report that assesses all current and past loans and credit, and your payment history on all of them. There are five key items used to calculate your credit score, and some have more weight than others:

- Payment history: timely payments mean a higher score. The score is lowered for late payments, over-limit accounts and bankruptcies.

- Amount you owe: this is your debt-to-credit ratio. A high credit card balance would lower your credit score.

- Length of credit history: how long you’ve been using credit and how well or poorly you’ve managed your finances since then.

- New credit accounts and inquires: this includes new accounts opened recently and inquiries to companies you’ve applied to for credit.

- Types of credit in use: this includes all your credit accounts (credit cards, mortgages, loans, etc)

Where can you get a credit report?

There are few major agencies that provide credit reports in the US and UK. In the US, this includes only 3: Experian, TransUnion and Equifax. For the UK, we recommend the Credit Expert Report from Experian over other options. They provide a more concise and easy to read credit report. You can view an example of a report here.

Understanding the setup

A credit report is divided into four sections: your identifying information, credit history, public records and inquiries. The first section is very self-explanatory: it’s your personal identifying information such as your name, ID or social security number, phone number and so on. Make sure all the information is correct before proceeding to the next section.

The next section is very important: your credit history. Here, you will usually see everything organized in chart form. The information included here will be:

- the name of the creditor and account number

- the kind of credit (i.e. mortgage, car loan, store credit card)

- whether the account is in your name alone or with someone else

- amount of the loan or credit

- how much you still owe

- fixed monthly payments

- status of the account (inactive, open closed, fully paid, etc)

- how well you paid the account

Most credit reports will show a summary in chart form of all the above information as well.

The third section, public records, will hold information like bankruptcies, judgments, tax liens, court records and at times, overdue child support. Only severe financial issues will appear in this section and they can easily trash your credit.

The final section is inquiries. It will list everyone who has asked to see your credit report within the last two years, including you. Only “hard” inquiries are shown to lenders, meaning that they will only see past inquiries in which you filed out a credit application. Soft inquires will only be shown only to you. These include any companies that wanted to pre-screen you for credit offers, potential employers or current creditors.

Understanding the score

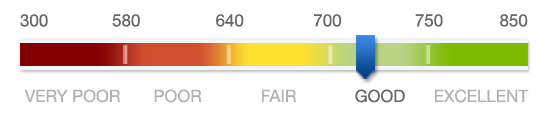

A good credit score depends on the scoring system used by your lender or credit agency. As it usually goes with a credit score, the higher the number, the better your score. Depending on your score, a lender may be willing to grant you credit including auto loans, mortgages, and even credit cards. If you use a credit reporting agency, you’re likely to be within these numbers:

- Less than 600: Lower than average credit score. The lower, the worse your score.

- 600-750: average rating. Most credit scores fall in this bracket.

- 700+: good credit management

How’s your credit score? Do you need to improve it?

All The Frugal Ladies Personal finance with a feminine touch

All The Frugal Ladies Personal finance with a feminine touch