Buying your first house is an accomplishment every adult would love to achieve. After all, a house is more than just an investment – it provides a home, a level of security and can be a foundation for starting a family.

However, not everyone is disciplined enough to control their spending habits and eventually save enough money for an important investment like a house.

In this article, we will give you examples of habits that you must limit in order to save money towards a bigger goal, like buying a house.

Quit these habits altogether and you will see your savings increase time and time again, jump-starting your opportunity to invest in real estate.

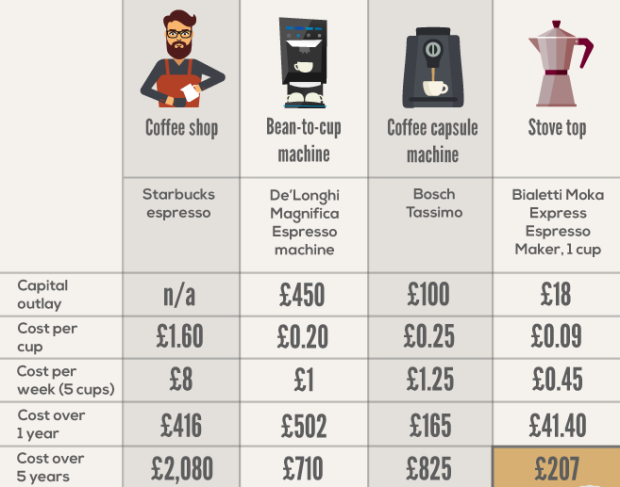

Buying artisan coffee

What is the difference between coffee from a coffee chain giant and the brewed coffee in your house or office? The answer is the price you pay (okay, also the taste but at the price you pay, it’s not significant enough).

If you’re spending $5 for a cup of coffee every working day, it adds up to a whopping $1255 ONLY on coffee. Ridiculous! How about making your own coffee? You will save a lot by the end of the year. Plus you’ll save yourself from a sugar-loaded, daily drink.

Eating out everyday

Reduce trips to your favorite restaurants. If you want to start saving now, then you should make some sacrifices like cutting out your everyday dining out experience.

This is a difficult one for me because I love the easy laziness of eating out at restaurants. But one restaurant outing is often equal to the cost of one week of food purchased at the supermarket. It’s just bad business!

Keeping your computer on

Are you the type of person who always keeps your computers and screens on? If you’re not downloading important documents, be sure to shut down your computer or at the very least set it to sleep. You will save on electricity consumption by doing so.

This should be your go-to stance on any electronics that are not in use. Shut them off – save on electricity bills.

Leaving your appliances plugged in

As above, leaving your appliances plugged in consumes energy and that equals lost money. Be sure to unplug electronics you don’t use often, especially for long trips. Some people prefer to unplug all electronics every time they leave home, but I can’t be bothered to put that much effort.

In my home, electronics like the oven, air conditioners, and lamps in lesser-used rooms are always unplugged. If you need help understanding which appliances you should unplug to save money, take a look at this article.

Expensive flying habits

First of all, never fly first class. If you can’t afford to buy a house, you certainly can’t afford the luxury of first class flying, regardless of the temptation.

Second, do not buy pricey items at the airport or especially in the plane. Stay away from those glossy magazines full of items you never thought you needed, but seem too cool to pass on.

If you can find cheaper seats or deals – do it! I do this all the time and I have saved at least $15,000 in a lifetime of flying.

To give you an example, when I was in the airport in Peru, they overbooked my flight. The staff asked someone to give up their seat in exchange for a $600 voucher and a night in the airport hotel with food included. I jumped (literally jumped) at the opportunity and got a free night in a 5 star hotel + $600 off my next flight.

Maxing out your credit cards

Credit cards look like a gift from heaven at first but as time passes and you just keep swiping and swiping everything, you’ll realize that it’s actually a burden not a gift. Stop maxing out your cards and start becoming conscious of what you’re buying.

Buying designer items

I know… we all like to look hot & on trend in our high quality designer clothes. It’s not an easy thing to give up… but every $100 extra you spend on a shirt is one small step away from the house of your dreams.

Leave the luxury bags, shoes (oh no, not the shoes!), and clothes behind. Start using your paycheck for savings instead of chic outfits… the cute clothing can come back into your life once you’re on-spot with your savings.

Riding an Uber

How fun and convenient it is to get an Uber! However, it costs a lot, too. Unfortunately, saving up for a house means ditching the Uber or private taxi… and taking the bus or train. Bus and trainer passes are far cheaper, especially if you buy a monthly pass that covers your day-to-day travel.

Better yet? Using a bicycle or walking, but that all depends on the distance between your current home and work.

Smoking

Smoking is not only dangerous for your health, it’s dangerous to your pocket. Imagine how much you could save by no longer smoking! To top it off, there’s the added benefit of a healthier lifestyle, too.

Taxes on smoking go up all the time – the government wants to discourage your smoking habit. The price is only going to go up, and your ‘luxury’ habit will keep you away from saving.

Drinking

Like with smoking, drinking is not only a hazard to your health but it’s also a waste of money. Bars charge an insane amount of money for a drink. The last bar I went to charged me a whopping $13 for a basic cocktail that was 50% juice, 49% ice and 1% alcohol. Yeah, I’ll take a glass of tap water from now on…

*****

If you start taking saving seriously, in a few months time, you’ll be able to see the savings add up. Get rid of the expenses that are eating away at your pocket dollar by dollar so you can reach your goal of having a new home. I’m now on that path myself and with a goal to acquire land for sale in Sydney at a residential village. As difficult as it is, I know it will be well worth it!

Thanks to featured image for the featured image

All The Frugal Ladies Personal finance with a feminine touch

All The Frugal Ladies Personal finance with a feminine touch