Investing in the stock market is appealing to a lot of people, but the actual process can be a little bit overwhelming. Setting up a stock portfolio typically means picking a trustworthy broker, putting a significant amount of money (sometimes up to about $25,000) into your account, and then attempting to manage a dizzying amount of activity. Meanwhile, you’ll have to pay fees to execute each and every trade, and you can only really devote a responsible amount of attention to the process if you treat it as your occupation.

Fortunately there are plenty of alternatives to managing your own portfolio in this sort of fashion.

Mutual Funds – Trust The Professionals

When you invest in a mutual fund, you’re doing most of the work you’re going to have to do with the initial decision. These funds are designed to lump multiple investors’ money together and spread out investments over a range of strategically diversified holdings. Gaining access to the size and diversity of the fund is a major benefit in and of itself. However, buying into a mutual fund also essentially means you’ve hired a professional investor to monitor your holdings. You’ll owe fees to the mutual fund manager, but the actual stress of the investments is out of your hands.

Forex – Trade In Currency

Forex is essentially the buying and selling of different currencies against one another in an attempt to capitalize on their fluctuating values. It’s commonly suggested as one means of diversifying an investment portfolio because it’s not directly tied to the performance of stock exchanges. But it’s also a nice option to consider for people looking for low-hassle investing, because it offers you the ability to access the market for longer hours than you can if you’re in the stock exchange. The forex market is open 24 hours a day, meaning if you want to establish an after-hours trading regimen, you can do so.

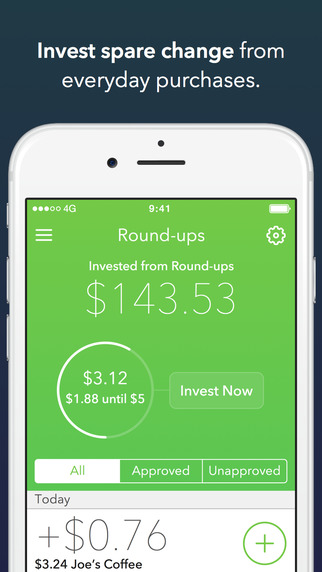

Acorns – Put Your Change To Use

You may have heard of Acorns by now. It’s basically an investing app that’s meant to take some of the risk and all of the hassle out of investing. It’s a little bit like a mutual fund, in that you’re buying into an existing portfolio setup. The app allows you to choose whether you want an aggressive or conservative portfolio, and it then puts your money to work automatically. The catch is where that money comes from—Acorns invests your spare change. It links up to your accounts to take the fractions of dollars that would round up to the nearest dollar on your purchases and puts them into the fund. It’s small, but it’s easy.

Robinhood – Invest On Your Terms

Robinhood was designed to take the fees and commissions out of stock trading for individuals who are turned off by how expensive it can be to manage a portfolio. Beyond that, it’s pretty much a mobile investing platform. It lives up to its advertisement as “free stock trading,” and it holds potential to disrupt trading tendencies on a wide basis. However, the actual stress of making trades and finding the time to manage your portfolio are still on you if you choose to use Robinhood.

In their own ways, each of these options and programs can simplify the investment process a great deal. They’re not without their flaws, but they’re certainly worth considering for those who find ordinary investing daunting.

Featured image designed by Freepik.

All The Frugal Ladies Personal finance with a feminine touch

All The Frugal Ladies Personal finance with a feminine touch