Despite the opportunities to slowly grow wealth, only 22% of Millennials have taxable investment accounts, compared to Gen Xers at 29%, Boomers at 39% and Silent Generation at 53%.

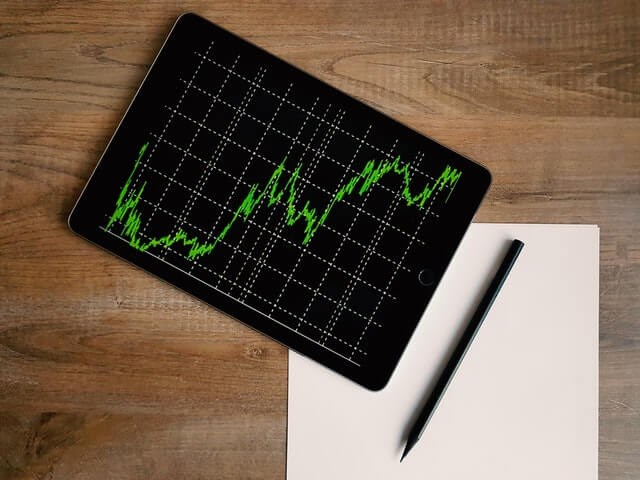

Making small investments into the stock market is a great way to grow wealth, and the great news is that anybody can invest.

Depending on the amount of money you want to invest and what your overall involvement level and goals are, there are a few ways to go about your venture into stocks and trading that will have you on the path to making millions in no time.

Utilize a Robo-Advisor

If you know you want to invest money but don’t necessarily know how to go about it, try looking into utilizing the services of a robo-advisor.

This is a service that offers low-cost investment management for you and is a great way to dip your foot into the industry without having to risk too much.

This type of service is typically offered by all of the major brokerage firms around today, and they will invest your money for you based on your specific goals.

These services are typically recommended for beginners as they provide you with easy access to your initial setup and will yield a customized, diverse portfolio from the get-go.

Open a Brokerage Account

These types of bank accounts allow you to invest in a variety of stocks and funds by buying and selling them through an online platform.

Brokerage accounts vary from typical savings accounts in that, rather than earning a fixed interest rate on your money like you would with a savings account, a brokerage account earns or loses money based on the performance of the investments you have chosen.

Crediful advises that if you’re looking to invest over the long-term, then it may be worth considering a brokerage account as part of your savings portfolio.

Always Look to Diversify

The easiest way to reduce risk is to diversify your portfolio. Some of the best and brightest investors own stocks across different companies in different industries and even in different countries to ensure that if one performs badly that it won’t necessarily affect their entire wealth.

Once you have the hang of trading and investing it is wise to diversify your investments across stocks, bonds, real estate, commodities and collectibles.

If you have already decided to go with a robo-advisor they will likely already have done this for you, but as you gain income and knowledge you can figure out for yourself which ones are best for your desired goals.

Remember to Set Long-Term Goals

As you begin to invest in the stock market, it is important to ask yourself why you are investing in the first place to understand and form long-term goals.

Your goals and investment activities will be different if you are saving for retirement, for future college expenses, to purchase a home, or to build a passive income stream.

To build long-term wealth, try investing small amounts into low-risk portfolios at first and build your way up from there.

If investing in the stock market still seems intimidating, look into taking an online course. FinGrad offers stock market courses for those interested in learning more about the stock market.

All The Frugal Ladies Personal finance with a feminine touch

All The Frugal Ladies Personal finance with a feminine touch