What are the first thoughts that come to mind when I hear the word, “finances”?

Do you see numbers running across a screen, calculators, credit card bills, your wallet, ATM machines, tax forms? Do you cringe in your seat? Do you rub your head from frustration? Anyone see themselves diving into a pool of gold coins like Uncle Scrooge from DuckTales? My guess is we are all more likely swimming in our own mixed emotions and general sense of feeling overwhelmed.

But, finances don’t always have to be frustrating, scary, or even boring.

I recently stumbled across a … less tradition … YouTube video on finances. And, it was actually entertaining! It features two personal finance bloggers on the streets of NYC rapping their way through tips on money management and budgeting. Have you seen it, yet?

After coming across this music video, I wondered what else is out there that could change the way we perceive money management. So began my hunt.

Here are 5 awesome resources that will get in you the right mindset when it comes to your personal finances:

1. Fun Finance Quizzes

I found a really great quiz from Kiplinger that also explains the reasoning behind the answers. It’s fun, educational, and I can guarantee you will learn something new that can significantly help you make smarter money decisions. I scored 8/12, so I have a lot to learn, still! Here is the quiz:

http://www.kiplinger.com/quiz/saving/T065-S001-financial-truth-or-bunk-round-i/index.html

2. Funky Finance App

We’ve talked about incredible apps, such as Mint, but I recently found a new app with fun characters, visuals, and budget lists. Let me introduce you to Toshl, which literally describes itself as “a funky mobile financial asisstant that makes finance fun.”

3. ‘Adult’ Cartoon Series about Personal Finance

Have you seen ‘Funny Money Man’? He serves up important finance points in fun and easy-to-understand ways. In this one video (of an entire collection), Funny Money Man breaks down our possessions into two categories: Money Losers vs. Money Makers. It really can be that simple; he explains what goes into which, and why it is so crucial to invest in Money Makers (e.g., mutual funds) early on.

It’s a funny and smart animation series that makes you take a hard look at your wealth (or lack there of) and gives you valuable information on how to move ahead.

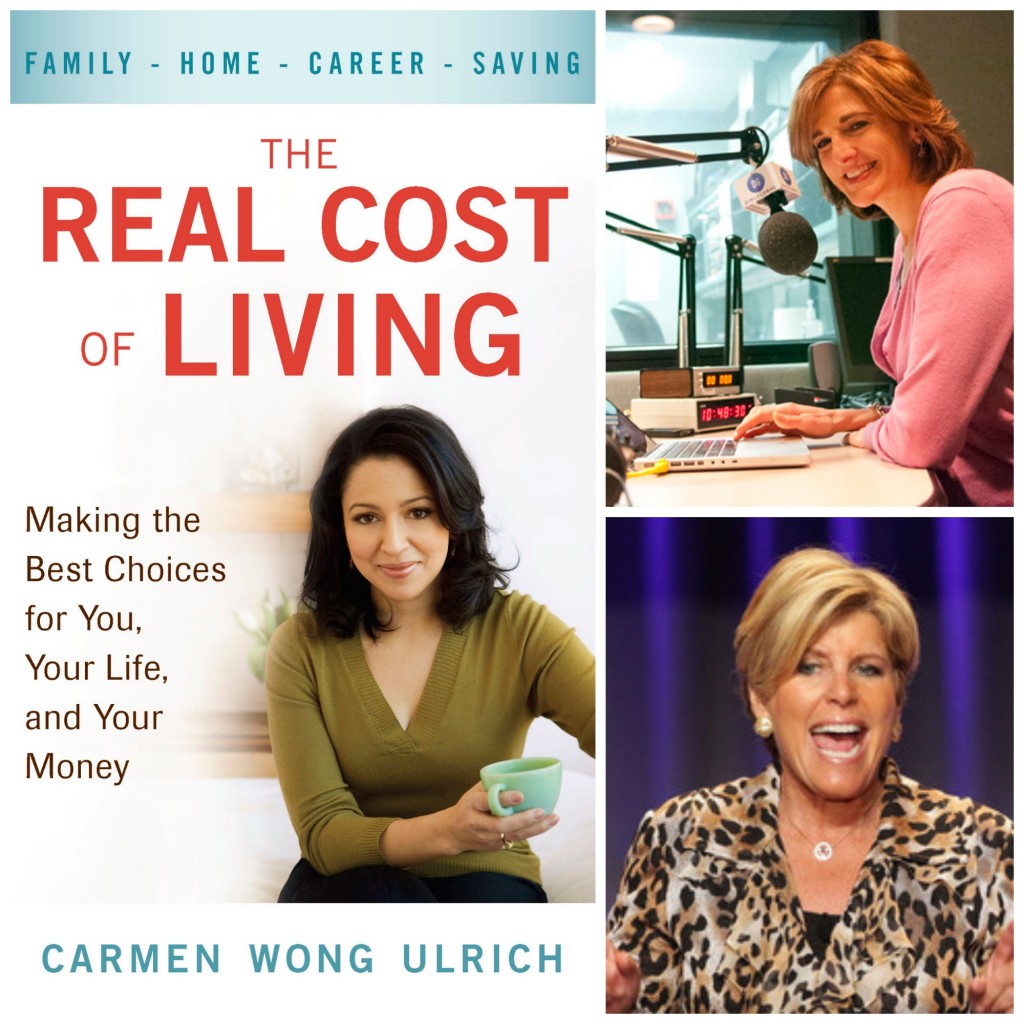

4. Inspiring Women in Finance

Maybe it’s because I’m a woman, but sometimes I just prefer listening to a woman who seems to have all the answers. I have a few personal favorites, such as Suze Orman, Carmen Wong Ulrich, and Jill on the Money. If you are looking for straight-talk, answer to real people’s questions, and some sass on the side, these women will go beyond your standards and expectations.

5. Gamification in Finances

Making a game of your finances is no playing matter! It can actually be extremely useful, education, and dare I say enjoyable! Enter Bobber, an innovative and engaging tool specifically built for Gen Y. It is a social + gamified platform, which is largely centered around goals and the ability to track incoming and outgoing money with more color, “challenges” and “quests.”

Your Turn: Although I’ve discovered 5 great ways to flip our views of money management, I know there are plenty more out there. Where do you turn when you need a good kick in the butt to get you back into reviewing your personal finances?

All The Frugal Ladies Personal finance with a feminine touch

All The Frugal Ladies Personal finance with a feminine touch