My boyfriend has the bad habit of not checking his credit card statements. The month comes and goes and he has no idea how much he spent or if he’s still under budget. Worse so – as my polar opposite, he’s indifferent.

Things are getting more serious between us, so I’ve requested he be more responsible about his savings and expenses. And so we started working through tons of past credit card purchases to see what he’s spending and where he could cut-back.

“$200 for website hosting?! You don’t have a website… why are you paying for such expensive yearly hosting?” He shrugs. He has no idea what that yearly recurring expense is, even though he’s paid for it for 3 years.

I start my investigation. Turns out, his credit card information was stolen and was being used by a man in Jordan who was very careful about his purchases. For three years, a Jordanian man was making online purchases using my boyfriend’s credit card info, spending at least $1000 overall.

It didn’t raise a red flag to the credit card company and it didn’t raise a red flag to my boyfriend, who was so indifferent about his finances, that he always assumed everything was going okay.

And just like that, he lost $1000. A thousand dollars that could go to a cruise, a vacation, a new mattress.

So in today’s day and age of online shopping – how do we ensure that our credit card information is safe? Here are some tips to help you out!

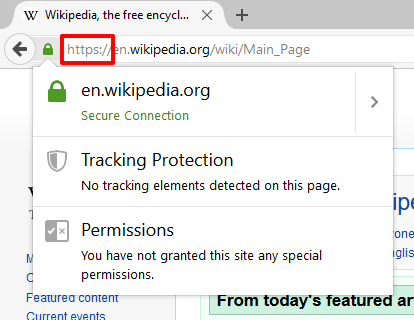

Verify Site Security:

Make sure the websites URL contains an “https”. It helps if there’s a padlock symbol or VeriSign emblem on the bottom of the page. These insignias demonstrate that the e-Commerce site uses encryption to protect sensitive date.

Avoid Purchases Using public Wi-Fi:

Although wireless communication has several distinct advantages, using public Wi-Fi to place an order is usually not a good idea. Whenever you are using a cellphone, switch over to a land-line phone or a secure router to make a purchase. Additionally, avoid semi-private and public access computers.

Only use trusted credit card providers

Ignore letters and emails offering you credit cards. Providing them with access to your personal and bank information could leave you in a situation of theft. Instead, only apply for credit cards from companies you trust who also use enhanced security measures to protect your information.

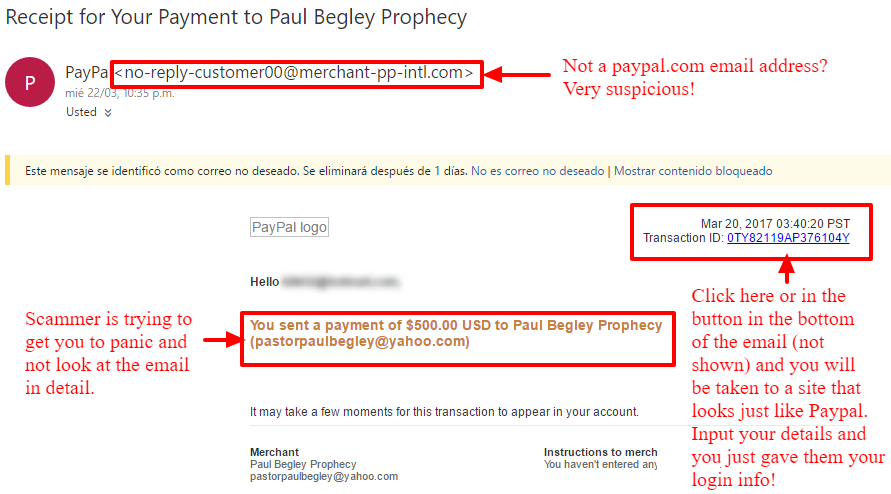

Check the URL:

Best practice is to type in the web address, carefully inputting the information letter by letter, to avoid scams. Many sites appear authentic, promising security features while presenting false insignias and protection. Don’t trust links to sites that arrive by email.

Use e-Commerce Sites you Trust:

Use ‘tried and true’ sites to prevent the risk of problems and to reduce security threats. Access a business bureau to determine whether individual companies have had complaints filed against them. If you enter the name of an e-commerce site and there isn’t any information it may be best to avoid it altogether.

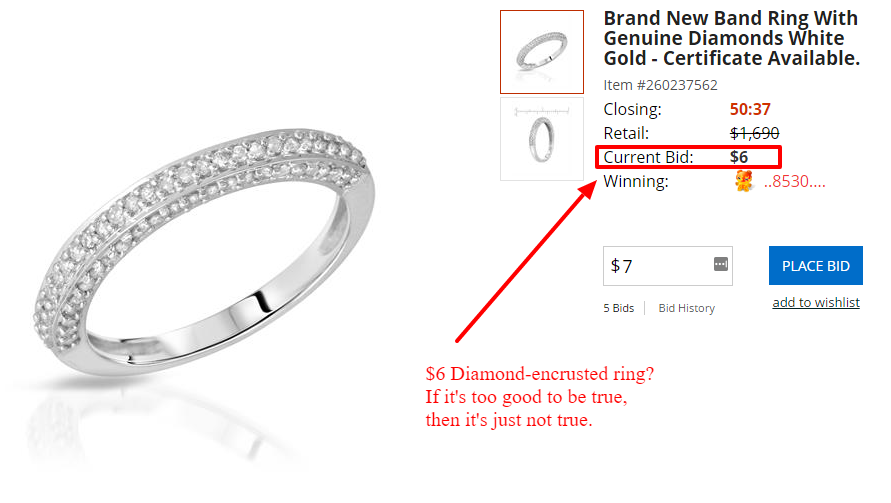

‘Too Good to Be True’:

If a deal seems just ‘too good to be true’ it probably is. Scammers take advantage of consumers by selling illicit items at drastically reduced prices. If you have never heard of a site, ask relatives and friends what they think or conduct an online search to find out more about the company’s reputation.

Provide Necessary Information:

By law, you are only required to provide your card’s number, expiration date, and the card’s security code; occasionally you’ll also need to present a mailing address. Never include the number for your card in an email of social media message. If you receive a follow-up email requesting any of your info, recognize that it’s probably a scam. If there is a problem with your order, a legitimate business will ask you to log back onto the site, or call them directly.

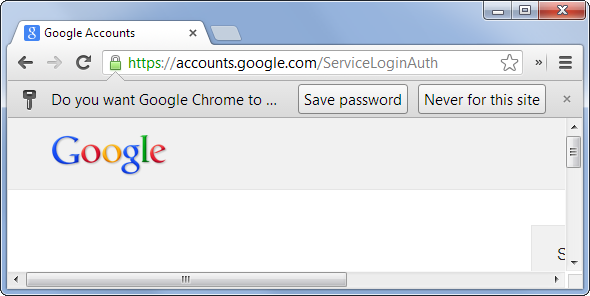

Don’t Store Information Online

Storing information online opens the door to hackers, coworkers, and teens who share your computer. Whenever you are asked if you want the computer to ‘remember’ your password or card number and personal information, the safest answer is ‘no’! Ready access to a website and card information spells disaster.

Avoid Using Debit Cards:

For more expensive purchases, it’s generally better to avoid using a debit card. Debit transactions are not subject to the same protection as most credit cards. Since money comes directly out of your bank account, potential fraud investigations could keep your money in a state of limbo for an extended period of time.

Use an Intermediary:

Intermediaries, like PayPal, are great for multiple vendor sites. The intermediary receives the payment which is then sent on to the merchant, without the seller ever being provided with any of your personal information.

Finally, in addition to these ten tips, stay on top of the latest threats. To continuously play it safe while shopping online, never take anything for granted!

All The Frugal Ladies Personal finance with a feminine touch

All The Frugal Ladies Personal finance with a feminine touch